Understanding your cost of attendance

If you submit a Free Application for Federal Student Aid (FAFSA), the federal government requires BGSU to provide an estimated cost of attendance (COA). This COA isn’t what you will be billed as a student, rather the individual budget that is created to calculate how much financial aid you can receive. Some costs like tuition and housing (if living on campus) are included in your bill, while others like books, school supplies and transportation are not. That’s why our estimated costs include items that won’t be on your BGSU bill. These are still costs you may have to pay for, but they can vary from student to student.

Please Note: All of the following information is only applicable for the incoming 2024 undergraduate cohort on the Bowling Green Campus. Visit the BGSU Cost of Attendance webpage to locate a breakdown of the federal direct and indirect cost of attendance estimates for all current cohorts.

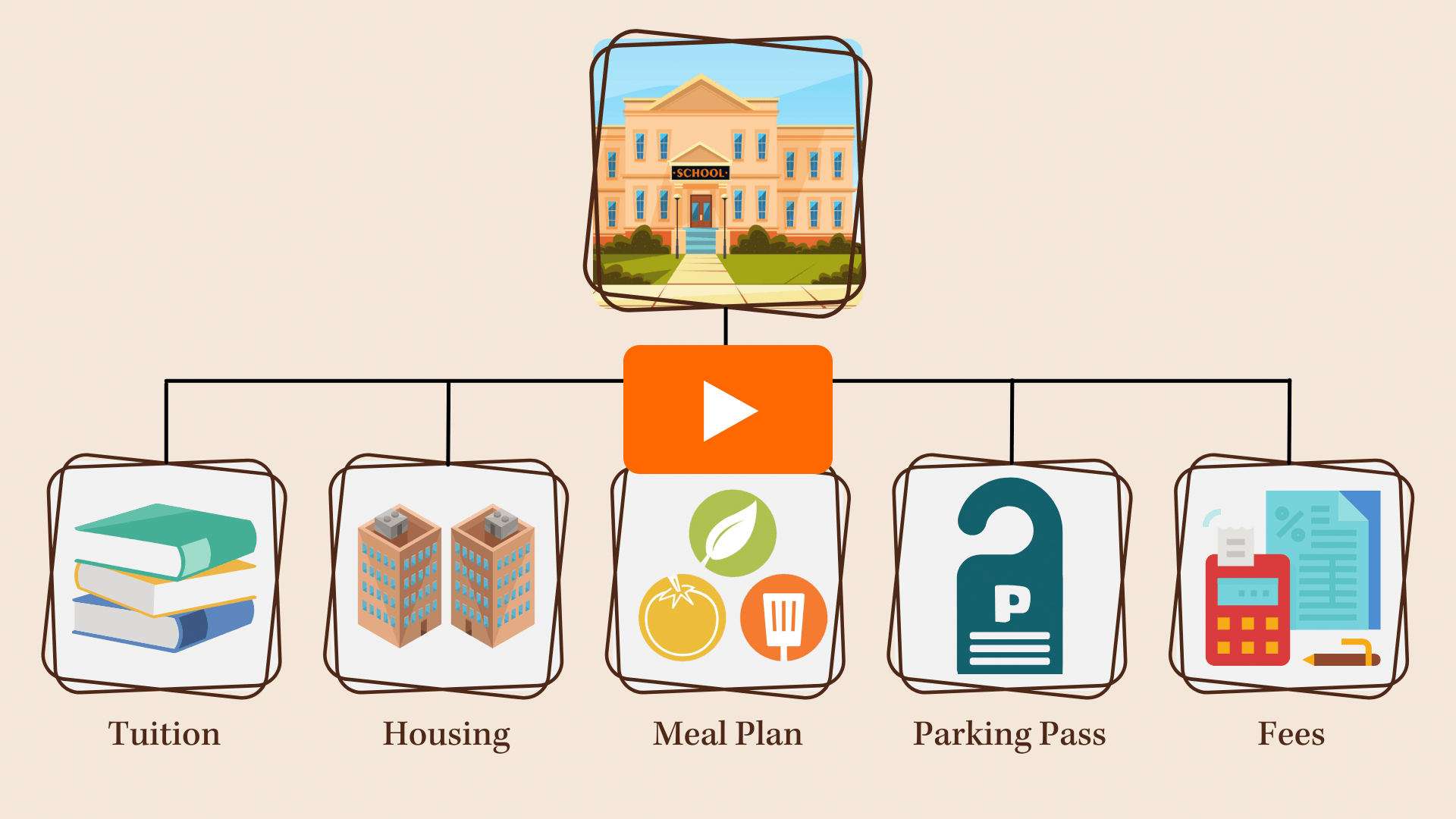

What does your Cost of Attendance include?

The COA budget estimates the cost of a typical student who attends BGSU, full-time, for both Fall and Spring semesters. It includes estimates for instructional and general fees, housing and food and allowances for books, supplies, transportation and personal expenses.

These estimates do not reflect the actual amount of money you might owe the University. Each student will receive a bill from the Office of the Bursar that shows their actual University charges. For more information, please refer to the BGSU Bursar.

What is included in your Cost of Attendance?

How to find your Cost of Attendance

You can view your individual COA anytime in your MyBGSU student portal.

Log in to your MyBGSU > Student Center

Select Financial Aid

Select Cost of Attendance

How is your Cost of Attendance (COA) Calculated?

The COA listed below are estimates based on an overall average of student expenses, as reported by BGSU student surveys and defined by the federal government. You may find that your own costs and charges vary depending on your living arrangements and personal spending choices.

Billed by BGSU

Full-Time Tuition

Based on 12+ credit hours.

BGSU Fees

Examples: Course fees, lab fees, college fees, etc.

On-Campus Housing

The Federal Government requires BGSU to provide an estimated cost of attendance (COA) based on an average of all BGSU housing options.

That rate is $7,908 per academic year and can be found in your MyBGSU. This is NOT the amount charged to the student.

On-Campus Food

The Federal Government requires BGSU to provide an estimated COA based on 21 meals per week.

That rate is $6,600 per academic year and can be found in your MyBGSU. This is NOT the amount charged to the student.

NOT billed by BGSU

Off-Campus Housing and Food

This is an estimated amount commuter students pay for housing and food. The rates are based on local housing rates and 21 meals per week. Your costs will fluctuate based on your living arrangement and food preferences.

Transportation

This is an estimated amount you may pay for transportation to commute to and from campus. Your actual costs will fluctuate based on your transportation needs.

Books/Supplies

This is the average amount students pay. The cost will differ based on the classes you are taking and the major you are in.

Other Expenses

This estimate is provided to account for miscellaneous personal expenses. This includes personal care items and clothing.

Tips to keep your budget on track

We want to give you necessary tools when creating your college budget and planning for the future. Here are some other tips to help keep your budget on track:

- Borrow as little as possible. You can reduce your overall loan amount by borrowing only what you need to cover your bill. Don’t borrow more than you can reasonably repay.

- Be aware of your loan costs. Your “total loan cost” is the principal amount plus fees and accrued interest for each loan you borrow and must repay.

- Begin making payments when you can. Before your loans go into repayment, making any payments (even small amounts) toward your principle loan amount will decrease the amount you'll pay in interest over time.

Updated: 05/02/2024 11:28AM